Chasing payments getting you nowhere? You’re not alone in your frustrations.

Unpaid invoices are a constant challenge for many small to medium size contractors across the construction industry, with Xero reporting that 53% of small business invoices are being paid late Australia-wide. Not only is the process of collecting unpaid invoices time-consuming, frustrating, and awkward, but it’s also bad for business. Cash flow issues, tarnished client relationships, and stunted business growth are just a few of the problems that can arise as a result of outstanding invoices.

But fear not: Marmalade is here to help. As part of their mission to empower small to medium-sized contractors with the tools they need to make smarter business decisions, they’ve provided us with their top tips to encourage prompt payment and avoid the chase once the due date passes. Read on and discover five ways you can handle your outstanding invoices like a pro.

1. Send an overdue invoice notice

This involves sending the original invoice with "overdue" stamped on it and is the first official step in dealing with an overdue invoice. Think of it as the “gentle reminder” that will prompt your customer to make the payment, bearing in mind that, from time to time, some clients make the honest mistake of simply forgetting to pay their invoices. An overdue invoice notice lets the client know that payment is still outstanding and needs to be settled soon.

2. Warn customers about late fees on invoices

No one likes incurring late fees, so make it very clear at the outset of the contract what charges will be added to the outstanding balance in the event of an unpaid invoice, and that these charges can be avoided by simply paying on time. Keep in mind that your late payment policy must be outlined to your client before they sign the contract, and you cannot demand or charge an excess on a whim. If you choose to issue a late payment fee on your invoice, state it clearly to ensure your message gets across. Many businesses may quote their late fees as a percentage, but your customer may appreciate a more straightforward approach – for instance, quoting both the current balance and amount of the new balance once the due date has passed.

3. Incentivise clients to pay missing invoices

Incentives serve as a great way to “motivate” your clients to pay their overdue invoices, if you’re in a position to offer them. Depending on the size of the invoice and the relationship you have with your customers, offering a discount in exchange for prompt payment can be advantageous, especially if you need the cash flow. If you’re worried about whether they will deliberately hold out payment in the future hoping to benefit from this incentive again, be sure to make it clear that it's a one-off or limited time offer.

4. Hire a debt collector

If all else fails, hiring a debt collector is still available as a last resort to get your overdue invoices paid in full. Debt collectors are equipped with the right tools and strategies to do this job efficiently, as well as being well-versed in legislation regarding late payments and can offer legal advice if needed. Be mindful though that the use of a debt collector could negatively impact your future relationship with your clients, so consider this option carefully. Debt collection agencies also typically take a large portion of the invoices they collect (generally around 25%), so you need factor in this potential loss when considering this option.

5. Consider technology-enabled invoice payments

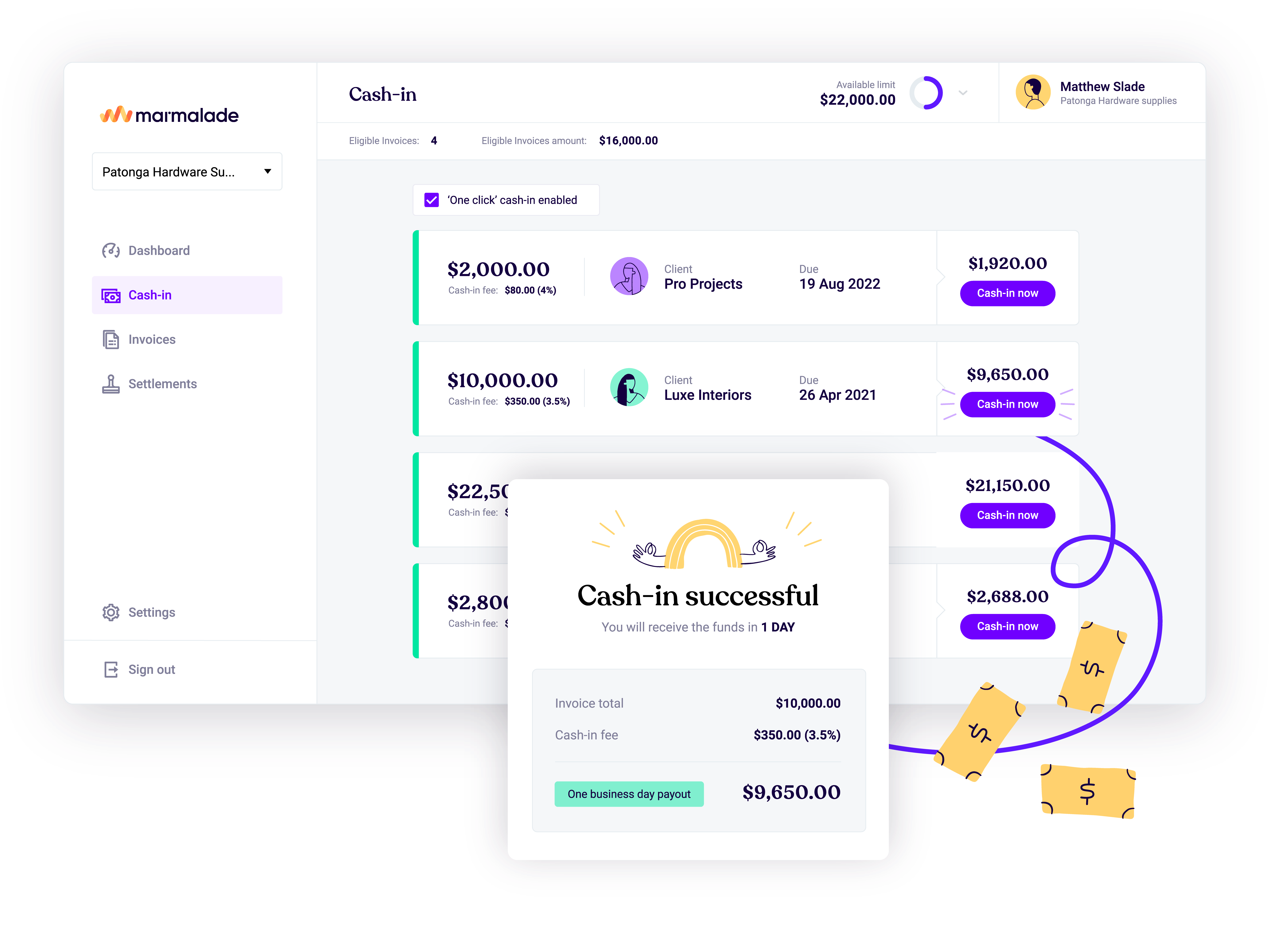

When the hassle of chasing unpaid invoices gets the better of them, many small to medium-sized companies end up selling their unpaid invoices to a finance lender. While it can be a viable option, there are better ways to facilitate invoice payments that won't leave you potentially out of pocket or blindsided with hidden lender fees. For example, with Marmalade, you can choose to get paid instantly for your invoices regardless of the payment terms you offer clients for a low one-off fee of between 3-5% per invoice. Their platform is user-friendly and offers automatic reconciliation for invoices, and Marmalade also sends out automatic payment reminders, which helps you save time and resources. It's a great way to get paid faster and easier while keeping your clients onside and freeing up the cash flow needed to grow your business.

Say goodbye to the bother of chasing unpaid invoices

The days of waiting weeks or even months to receive payment on your invoices are over. Marmalade makes it easier than ever to ensure you get paid quickly, allowing you immediate access to the funds you need to keep your business running smoothly. By making the switch to Marmalade, you can also benefit from the following advantages:

- No credit checks, interest rates, or lock-in contracts

- No credit risk — Marmalade absorbs the risk of non-payment from customers

- No extensive paperwork or security is needed

- Clear visibility on the status of all invoices

- Seamless integration with your accounting platform

When it comes to overdue payments, cut to the chase with Marmalade

Marmalade’s innovative platform is the perfect solution for companies looking to cut down on chasing overdue payments and turn money owed into real capital. From reducing invoicing errors to keeping your cash flow stable, Marmalade is the simple way to manage all your invoice payment processes in one place. So why wait? Make the awkwardness of requesting payment on an outstanding invoice a thing of the past and discover a better way to get paid with Marmalade. Visit their website to find out more and open an account today.